Beyond Next Ventures establishes its 3rd Fund Specializing in Deep Tech Ventures – Strengthening long-term support for global growth, all the way from seed to growth stages Beyond

2023.10.11

Beyond Next Ventures, Inc. (Headquarters: Chuo-ku, Tokyo, CEO: Tsuyoshi Ito) is pleased to announce the establishment of the BNV Fund – 3 (Official name: Beyond Next Ventures 3 Investment Limited Partnership). With contributions from existing investors of our 1st and 2nd funds, including Organization for Small & Medium Enterprises and Regional Innovation, JAPAN, MUFG Bank, Ltd., Dai-ichi Life Holdings, Inc., Tokyo Century Corporation, and with support from new investors that include SMBC Nikko Securities Inc., Mitsubishi UFJ Trust and Banking Corporation, FFG Venture Business Partners Co. Ltd. and YAGAMI Co. LTD., the fund achieved its first close with over 10 billion yen committed out of its final target amount of 25 billion yen. With this, we will continue working on our aspiration to create deep tech unicorns from Japan solving significant challenges at a global scale.

Features of BNV Fund-3

1. Leading Finance from Seed to Later Stages

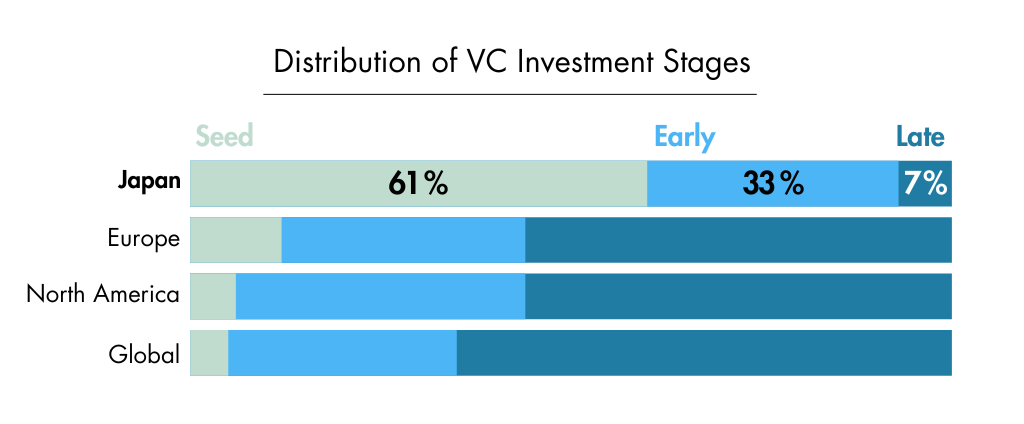

- In Japan, while the amount of venture capital investment continues to increase, the volume of later stage investments is significantly behind when compared to other countries. This has led to numerous cases of deserving startups finding it difficult to secure funds in middle-to-late stages. We believe that this lack of funding severely limits the ability of companies to go global and limits the prospect of producing more unicorns from Japan.

- In the Fund – 3, we are increasing the maximum investment amount per company to 2 billion yen, which is roughly 3 times the maximum limit in the previous funds. We are also extending the fund’s operational period to a maximum of 11 years, one year longer than before (plus an extension of up to three years with the consent of the limited partners). These features allow us to offer continuous financial support to investee companies in their journey from seed to scale.

2. Further Strengthening Company Creation

With the increased maximum investment amount, the BNV Fund – 3 aims to further enhance “Company Creation” activities by focusing our support resources to create unicorn companies on a global scale.

About BNV Company Creation model:

Deep tech startups, often emerging from universities and research institutions, still lack the personnel capable of advancing the commercialization of outstanding science and technology inventions. In response to this challenge, we work on forming ideal management teams by matching researchers building great technologies with entrepreneurial business leaders from our vast pool of 3,000+ management professionals. Furthermore, by collaborating with a network of domain experts, we are actively enabling the founding of innovative startups by helping them validate business concepts, construct business plans, and secure seed-stage funding.

3. A Gateway to Global Markets with a Focus on India

Envisioning a medium to long-term shift towards Asia, we are doubling down on our efforts to help our domestic portfolio companies go global. In particular, since establishing a subsidiary in Bengaluru, India, in January 2020, we have strengthened our business presence with local members. We have also onboarded dedicated personnel to support the entry of domestic portfolio companies into India.

4. Impact & ESG Investment

Starting from the BNV Fund – 3, we will implement Impact Measurement & Management practices when engaging with all potential investee companies, with an intent to generate both financial returns and societal impact through deep tech investments. We are also committed to investing responsibly by adopting an ESG policy.

Limited Partners of the BNV Fund-3 (As of October 4th, 2023)

Existing investors:

・Organization for Small & Medium Enterprises and Regional Innovation, JAPAN

・MUFG Bank, Ltd.

・Dai-ichi Life Holdings, Inc.

・Tokyo Century Corporation

New investors:

・SMBC Nikko Securities Inc.

・Mitsubishi UFJ Trust and Banking Corporation

・FFG Venture Business Partners Co., Ltd.

・YAGAMI Co., LTD.

In recognition of our past investment performance in deep tech from the seed stage, approximately 80% of our Limited Partnerships are continued investments by existing investors in the previous funds.We will continue our fund-raising activities in order to realise our final target size of JPY 20-25 billion.

Contributing to the Development of Japan’s Deep Tech Ecosystem

Since our founding, our company has been dedicated to building an ecosystem that accelerates the pace at which research advancements are commercialized to solve society’s challenges. We invested in approximately 80 startups, primarily in the deep tech. Through “BRAVE”, our program for promoting the commercialization of research findings, 52 companies have been established. From our “INNOVATION LEADERS PROGRAM”, which cultivates executive talent in the deep tech sector, we have produced over 40 entrepreneurs (with a total of more than 400 participants). Additionally, we operate “Beyond BioLAB TOKYO” a shared wet lab supporting early-stage bio-ventures. Through these programs (and more), we will continue to operate beyond the scope of a typical VC fund to support challengers in all deep tech sectors.

Our Past Investment Track Record

We established our 1st fund (around 5.5 billion yen) in 2015 and the 2nd fund (16.5 billion yen) in 2019. We invested in about 80 companies, primarily deep tech startups in Japan and India, within fields like healthcare, agri-food, etc. In the 1st and 2nd funds, we have achieved exits through 2 IPOs (SUSMED, Inc. and QD Laser, Inc.) and 5 M&As (Repetoire Genesis, Inc., GigIndia and etc).

Overview of the BNV Fund-3

- Concept: Solving humanity’s challenges through Japanese science/technology.

- Fund size: 20 to 25 billion yen.

- Number of investments: approximately 20-25 companies.

- Maximum investment per company: up to 2 billion yen.

- Operational period: up to 14 years (11 years + 3 years extension).

- Lead/Follow: In principle, we lead the rounds.

- Investment Stage: Continuous investment from seed to middle/later stages.

- Major Investment Targets: Healthcare, drug discovery & biotech, agri-food, digital & space, climate tech.

About Beyond Next Ventures Inc.

Creating the beyond next society; enabling exceptional people solving global challenges.

We believe deep tech scientific innovations can enrich the world. Gathering top talent and risk financing together with these innovations inspires new business models and ensures future generations by creating a reinforcing cycle of science and technology innovation.

The ecosystem we are building supports researchers with resources for business planning, HR team building, shared lab space with experimental infrastructure, and of course financing. As an ecosystem builder where “exceptional challengers” in the deep tech field gather, we continue to boldly explore new frontiers.

- Head Office: 3-7-2 Nihonbashi Honcho, Chuo-ku, Tokyo, MFPR Nihonbashi Honcho Building, 3rd Floor

- Subsidairy: Galaxy-Wework, 43, Residency Road, Shanthala Nagar Ashok Nagar, Bengaluru, Karnataka, India – 560025

- Representative: President & CEO, Tsuyoshii Ito

- Established: August 2014

- Business: Investment and growth support for deep tech startups in Japan and India, support for the commercialization of research seeds, cultivation and formation of management talent and teams, operation of shared wet labs, etc.

- URL: https://beyondnextventures.com/