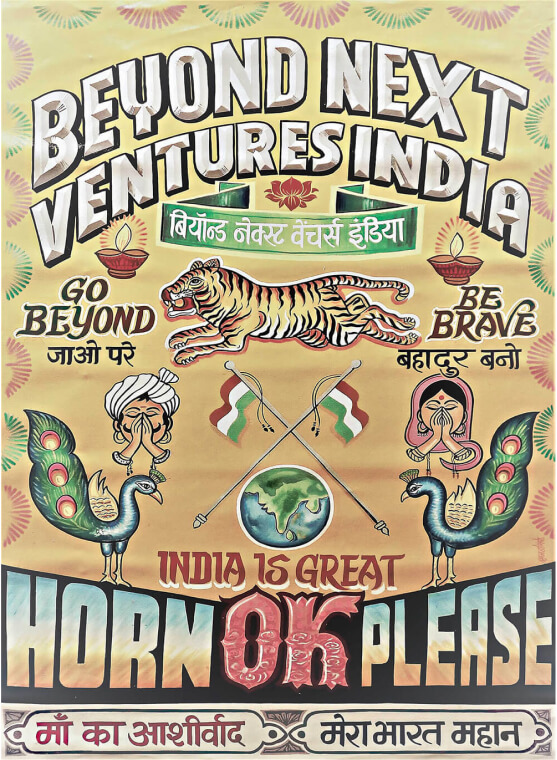

Investing in transformative ventures

with entrepreneurial spirit

At Beyond Next Ventures, we enable entrepreneurs striving to solve social issues by leveraging the power of transformative deep-science and deep-tech advancements. We are a long-term investor supporting our portfolio’s

journey from lab to market and then IPO.

Committing to cutting edge innovation in India

Since our inception in 2014, we are pushing the frontiers of an ecosystem where deep-tech entrepreneurs can thrive. We host one of Japan’s largest deep-tech acceleration programs, possess a state-of-the-art bio lab serving startups, and run programs that nurture industry professionals to become startup leaders.

Building on nearly a decade of experience in Japan, we started investing in Indian startups in 2019. For the upcoming decade (and beyond), we’re excited about shaping the Indian deep-tech venture ecosystem by building on our team’s extensive experience and networks in India and Japan.

TEAM

INVESTMENT

We invest in seed-stage startups working on deep-tech innovations and digital disruptions.

Our expertise lies in supporting early stage entrepreneurs solving important social / environmental issues.

-

Seed Investor

(Pre-seed~SeriesA) -

Deep-tech

Innovations -

Digital

Disruptions -

Impact Driven

PORTFOLIO

Our portfolio companies span Health-tech (medical devices, platforms, services, etc.), climate-tech (food, agriculture, etc), and digital infrastructure (edge AI, fintech, IT, etc.)

-

Phasorz Technology

One of the biggest telemedicine and consulting platform

-

Lil’ Goodness

Transforming snacking segment in India through nutrition based healthier product

-

Biomoneta

Developed tech Zebox that eliminates airborne viruses, pathegons and bacterias

-

GigIndia

Operates a matching platform for gig workers in India

Acquired by PhonePe (2022.3)

-

BigHaat

India's Biggest all digitial Agri-input platform

-

Faunatech Solutions Pvt. Ltd.

Deeptech Solution for solving massive problem of Mastitis in Dairy industry

-

GroMo

FinTech marketplace helping users sell financial products

-

Myelin Foundry

AI algorithms on video, voice, and sensor data for edge devices

-

ImpactGuru

India's biggest crowdfunding platform for the medical needs

-

MUSE Diagnostics

Next generation Digital Stethoscope for multiuse from Telemedicine to Education

-

Generic Aadhaar

Providing good quality medicines at affordable costs to consumers

-

MEDFIN

Offering the latest surgical procedures at affordable costs.

-

Wellthy Therapeutics

Modular, low-code digital therapeutics SaaS platform

-

Volt14

Silicon Anodes for high energy density Lithium-ion cells

Testimonials

CONTACT

Are you an entrepreneur passionate about building a better future? Are you keen about working together to enable a robust ecosystem for deep-tech entrepreneurship? We are waiting to hear from you. Please contact us here.

Beyond Next Ventures India Pvt. Ltd.

Galaxy-Wework, 43, Residency Road, Shanthala Nagar

Ashok Nagar, Bengaluru, Karnataka

India – 560025